Financial Framework of Healthcare Systems

Healthcare organizations rely on strong financial systems to keep operations steady. The foundation of that system lies in how well accounts receivable management functions. This process ensures every bill issued translates into timely payments that maintain organizational balance.

When managed correctly, accounts receivable serves as a bridge between patient services and financial stability. Delayed reimbursements can disrupt payroll, supply chain orders, and even care delivery. A streamlined billing process, however, keeps departments aligned and ensures that care continues without financial strain.

A healthy financial framework reflects directly on patient satisfaction. When hospitals and clinics operate smoothly, both staff and patients benefit from dependable services supported by stable revenue flow.

Revenue Integrity in Healthcare Operations

Revenue integrity ensures all financial activities in healthcare align with accurate coding, documentation, and billing compliance. It prevents underpayments, rejections, or missed revenue opportunities. By securing every transaction, it protects the revenue stream from the inside out.

The relationship between revenue integrity and accounts receivable is direct. When systems work together, data stays accurate from the point of care to final payment posting. This alignment reduces administrative waste and helps maintain transparency for insurers and patients alike.

Organizations with strong revenue integrity can also identify irregularities early. Whether it’s an error in charge capture or a missing claim attachment, timely intervention ensures consistent reimbursement.

How Does Accounts Receivable Support Care Delivery

Accounts receivable is more than a financial function; it’s a support mechanism for patient care. When payments flow without delay, resources remain available for essential equipment, staff, and treatments. This steady cycle sustains the overall delivery of care.

In hospitals, billing inefficiencies can reduce the funds available for patient programs or technology upgrades. By contrast, a responsive accounts receivable system ensures that revenue keeps pace with demand. The link between billing and bedside care becomes clearer once organizations experience fewer claim denials and smoother payment cycles.

Healthcare teams that understand the value of revenue flow can make data-driven decisions that strengthen both patient care and financial results.

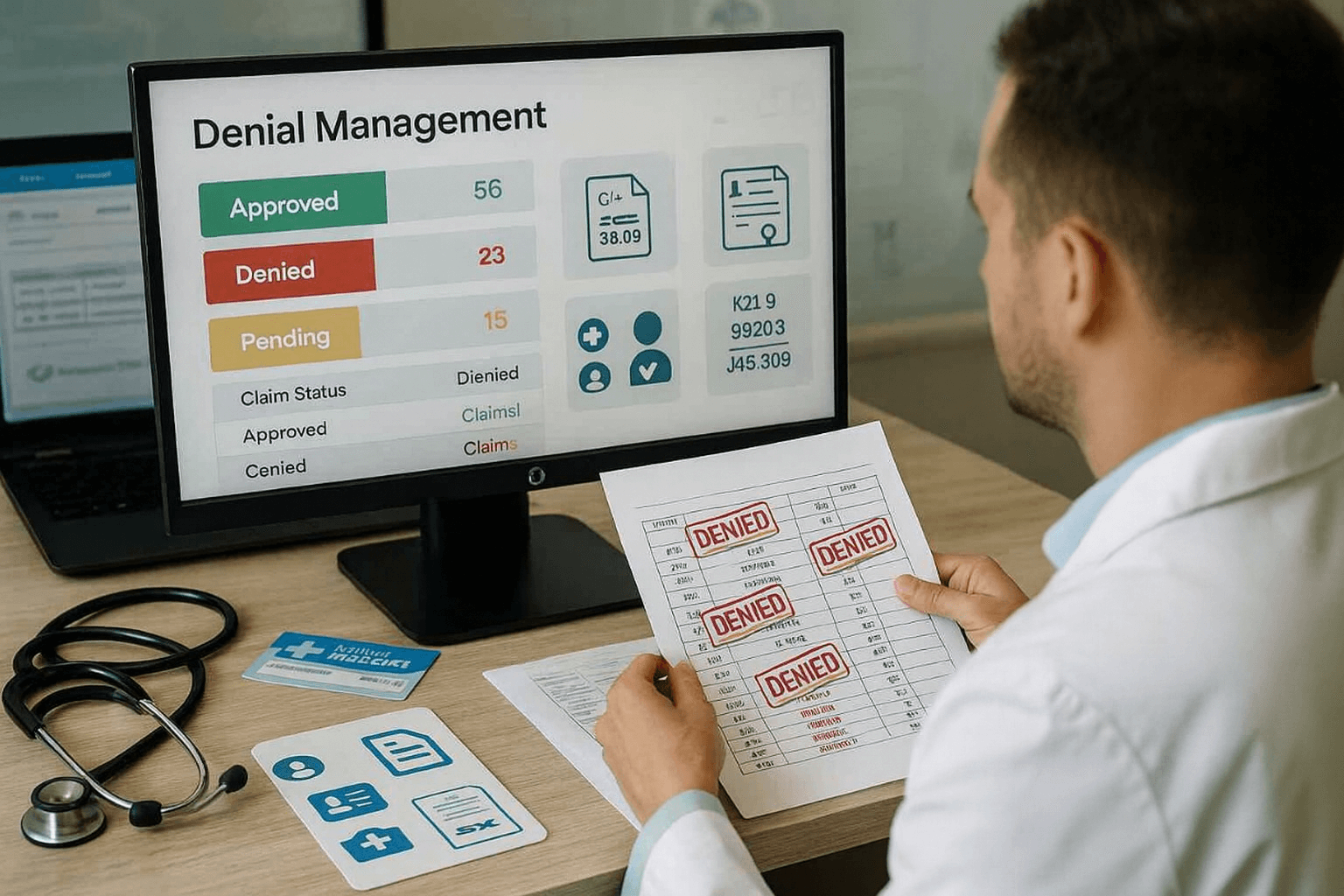

Claims Management and the Path to Payment

A well-managed claim represents the final stage of a successful care interaction. Claims management ensures the details of treatment are accurately documented and transmitted to payers. Accuracy, consistency, and timing determine how fast payments return to providers.

When claims are denied, administrative costs increase. Delays multiply, and revenue becomes unpredictable. That’s why refining the process through training, audits, and digital tracking tools is essential. Proper claims management allows healthcare systems to turn complex payer requirements into reliable outcomes.

Each claim that moves efficiently through the system enhances overall revenue health. Streamlined coordination also strengthens relationships with insurers and improves the financial cycle for patients.

Denial Prevention Strategies for Financial Stability

Denial prevention strategies act as a protective layer around healthcare finances. By preventing rejections before they occur, these strategies minimize wasted time and resources. They focus on pre-submission validation, documentation accuracy, and compliance checks.

Hospitals that adopt early detection systems reduce costly rework and shorten reimbursement timelines. Automation also helps by scanning data for errors in real time, flagging potential denials before submission. Combined with continuous staff education, these systems create a proactive culture.

A strong denial prevention framework not only preserves revenue but also increases team confidence in the accuracy of their work. Every approved claim represents a win for both the provider and the patient.

The Role of Patient Experience in Financial Health

Patient experience and financial health are deeply connected. A patient’s understanding of billing, coverage, and payment options influences their trust and loyalty. When communication is clear and support is responsive, confusion decreases and timely payments increase.

A healthcare call center often bridges the communication gap. It provides real-time assistance, explains charges, and helps patients navigate insurance claims. Through empathy and efficiency, these centers ensure patients feel supported at every step.

Hospitals that prioritize transparent billing see long-term benefits. They not only reduce the number of unpaid accounts but also strengthen their reputation for compassionate care. In an industry built on trust, this relationship is priceless.

Administrative Efficiency and the Future of Revenue Health

Administrative efficiency drives the sustainability of healthcare systems. Efficient operations minimize errors, reduce turnaround times, and improve staff productivity. When departments function cohesively, financial processes strengthen across the organization.

Automation plays a central role in this evolution. Systems designed to support medical billing solutions and healthcare reimbursement ensure that data flows accurately between departments. Predictive analytics highlight patterns in payment cycles, allowing decision-makers to adjust strategies before issues arise.

As the industry continues to modernize, combining human expertise with technology delivers measurable results. Administrative efficiency creates a structure that supports every layer of care, from the back office to the patient experience.

Ready to Strengthen Your Revenue Flow

A healthy revenue cycle allows healthcare providers to focus on what matters most, the patient. If your organization faces delays in collections or billing inefficiencies, there’s a better way forward. Through strategic accounts receivable management and denial prevention strategies, healthcare teams can achieve long-term financial balance.

Partnering with experts in revenue optimization empowers your system to adapt, recover, and grow. By combining accuracy, technology, and patient-centered service, every transaction contributes to a sustainable future.

Reach out today to explore how your revenue health can power better care delivery.